Keys to taking advantage of the benefits of electronic signatures in international business relations

By

The electronic signature is a strategic asset that has reached organizations with no expiration date, in a transversal way, being […]

See all the information of your interest through our news section

By

The electronic signature is a strategic asset that has reached organizations with no expiration date, in a transversal way, being […]

By

The Human Resources (HR) department of all types of organizations is the one that has experienced the most changes in […]

By

The changes that have taken place have ushered in a new way of understanding industry: the fourth industrial revolution or […]

By

The use of Big Data and digitalization have become the key levers for improving business competitiveness, reducing costs, time and […]

By

As we are used to hearing, “talk is cheap…” but digital evidence is not. And so it is, in fact, […]

By

Recently, Real Decree-Law 7/2021, of April 27, has been published, which amends Law 10/2020 (Adaptation of the Fifth Anti-Money Laundering […]

By

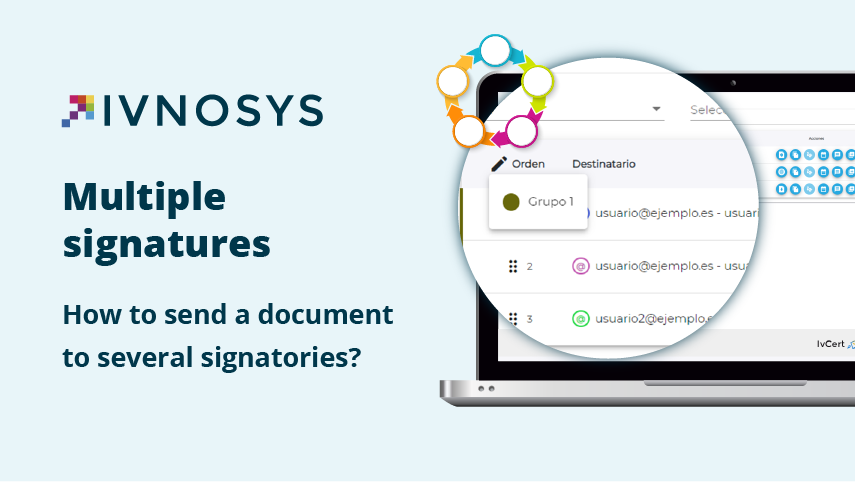

The electronic signature has many advantages for companies. Its use is usually applied between two signatories, for example, between the […]

By

How many digital signatures are there? What level of security do I need depending on my activity? What does a […]

By

The digital certificate accredits us when we work on the Internet and allows the electronic signature to be used in […]